DryRunĭryRun is cash flow forecast software that allows you to track invoices, bills and due dates so you can see who owes you what, when it will come in, when your bills are due and whether you’ll have the cash to pay them. You can also offer various levels of access to Pulse for coworkers, partners and investors to keep everyone updated at the level you’re comfortable with. If you use Quickbooks Online, you can connect it to your Pulse account to check the accuracy of your projections. If you do business internationally, you’ll appreciate that Pulse tracks cash flow and runs reports in multiple currencies.

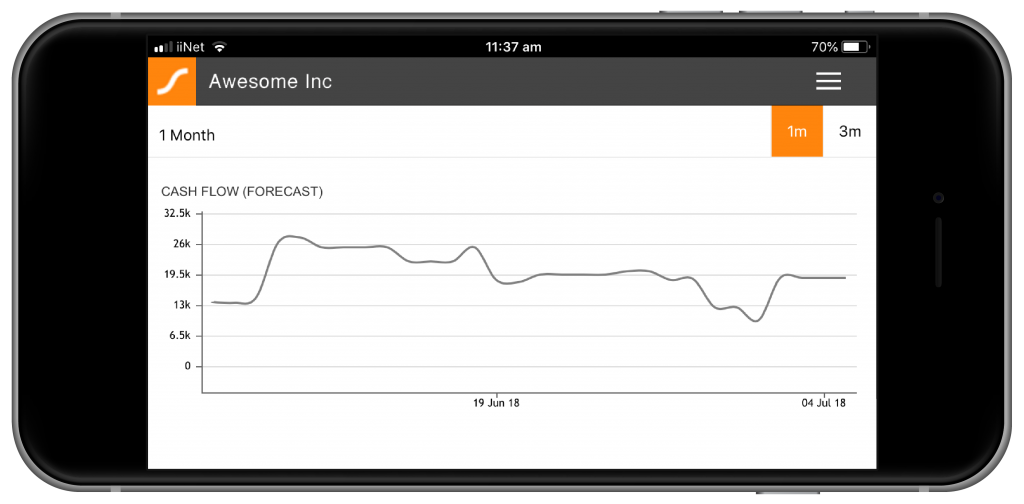

You can also use Pulse to see the impact that a new project, client or expense will have on your cash flow. Pulse allows small businesses to monitor cash flow (on a daily, weekly or monthly basis), forecast cash flow and generate visual reports so you can quickly see how everything looks. You can also use Float to create scenarios that model your short- and long-term cash flow. Float’s graphs can show you if you’re headed into the red and help you to model payment dates and create a plan to stay in the black. Float lets you to set budgets, details cash inflows and outflows, shows you what bills and invoices are due and predicts how these will affect your bank balance. Float automatically updates using data from one of these accounting platforms to create cash flow forecasts, saving you the trouble of manually entering the required information.Īs opposed to most accounting programs that show you the details of past financial performance, float allows you to see where your bank balance is headed in the future. Floatįloat focuses on generating cash-flow forecasts for businesses that use Quickbooks, Xero, and FreeAgent. And this, in turn, helps your business run much more smoothly - and stay ready for bigger opportunities you can’t take advantage of if you’re struggling just to keep up.Įach business has unique patterns of cash flow, but there are a variety of tools available to help all kinds of businesses track and manage this important aspect of their finances. This allows you to make decisions that can help your business veer away from red ink and stay firmly in the black. Monitoring cash flow means not only looking at past performance but also at projections of what your cash flow will be in the future. Simply put, if you don’t pay attention to your cash flow, you may find yourself without the money to pay your bills.

Cashflow forecasting app how to#

It’s crucial to understand what cash flow is and how to keep track of it - especially for small businesses that may not have huge cash reserves. Cash flow consists of the flow of funds into and out of your business.

0 kommentar(er)

0 kommentar(er)